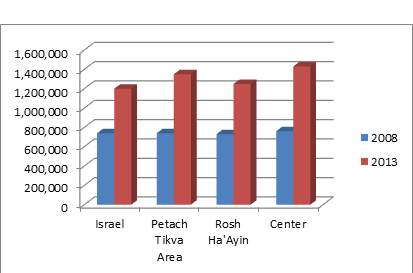

Rental prices for homes in Israel’s central region are rising fast, giving real estate investors an even better annual return. Shaun Isaacson from Creative Estates explains why.

Rental prices for homes in Israel’s central region are rising fast, giving real estate investors an even better annual return. Shaun Isaacson from Creative Estates explains why.

Summer 2015 is proving to be a hot summer for the real estate market, and rental prices are continuing to rise. Creative Estates has raised the rents on all of its properties by 5% over the past year, and continues to attract and retain excellent tenants. In some countries it is predominantly poorer people who rent properties, but in Israel it is considered normal for well-paid individuals, couples and families to rent a home for many years, for a number of reasons.

1) Israeli Banks are reluctant to lend – it’s difficult and expensive to get a mortgage to buy a property in Israel.

2) 30% deposit required – for an average home costing 1.8 million NIS, a young couple has to come up with 540,000 NIS ($142,000)

3) Mazal Tovs! – the marriage rate in Israel is still high – 50,000 couples tie the knot each year, generally leaving their parents’ home and renting an apartment.

4) Incoming Olim – Aliyah is still increasing, from France, the Ukraine, India, and all over the world, and most new immigrants to Israel start out renting.

5) Limited Space – Israel is a relatively small country with an increasing population, and there are also political reasons why developers cannot get permission to build in many areas.

6) Regional Concentration – Israel’s population is still highly concentrated in the Mercaz area – particularly the Sharon and Gush Dan regions where the well-paid jobs are, which keeps prices high in these areas.

7) City Life – Singles and couples tend to rent apartments in the city for a few years while saving money to buy a house in the suburbs or somewhere more family-friendly.

8) Focus on Luxury – Real estate developers are still building more high-end properties designed for wealthy overseas investors and fewer affordable homes for young couples and families.

9) First Time Buyers – the new government elected in May 2015 has promised to help first-time buyers, so many are waiting to see what measures will be introduced before they buy.

10) Rent Control Plans – rumors of government plans to control rent increases to 3% per year will not dampen demand or limit price increases. In fact, we expect 3% annual rent increases to become a standard contract term, even when inflation is much lower!

Shaun Isaacson is a qualified lawyer and realtor and has an MBA in Finance. He is CEO of Creative Estates Israel, which provides investment and property management services for property owners in Israel.